On Tax Day 2021, Downtown Seattle Renters Will Have Lost About $10K In Deductions & Will Have Missed Out On Over $290K In Appreciation Over The Last Decade.

For Tax Day, executives from Realogics Sotheby’s International Realty (RSIR), Caliber Home Loans, and O’Connor Consulting Group released research demonstrating that new tenants who chose to live in brand-new, luxury apartments rather than purchasing a similar condominium had paid more than $50 million in unrecoverable lease payments (or $218,983 individually) over the last decade. Meanwhile, the average renter lost out on an estimated $288,934 in average capital appreciation over the same time period, as well as $9,228 in income tax deductions in 2020.

2021 Exclusive Report

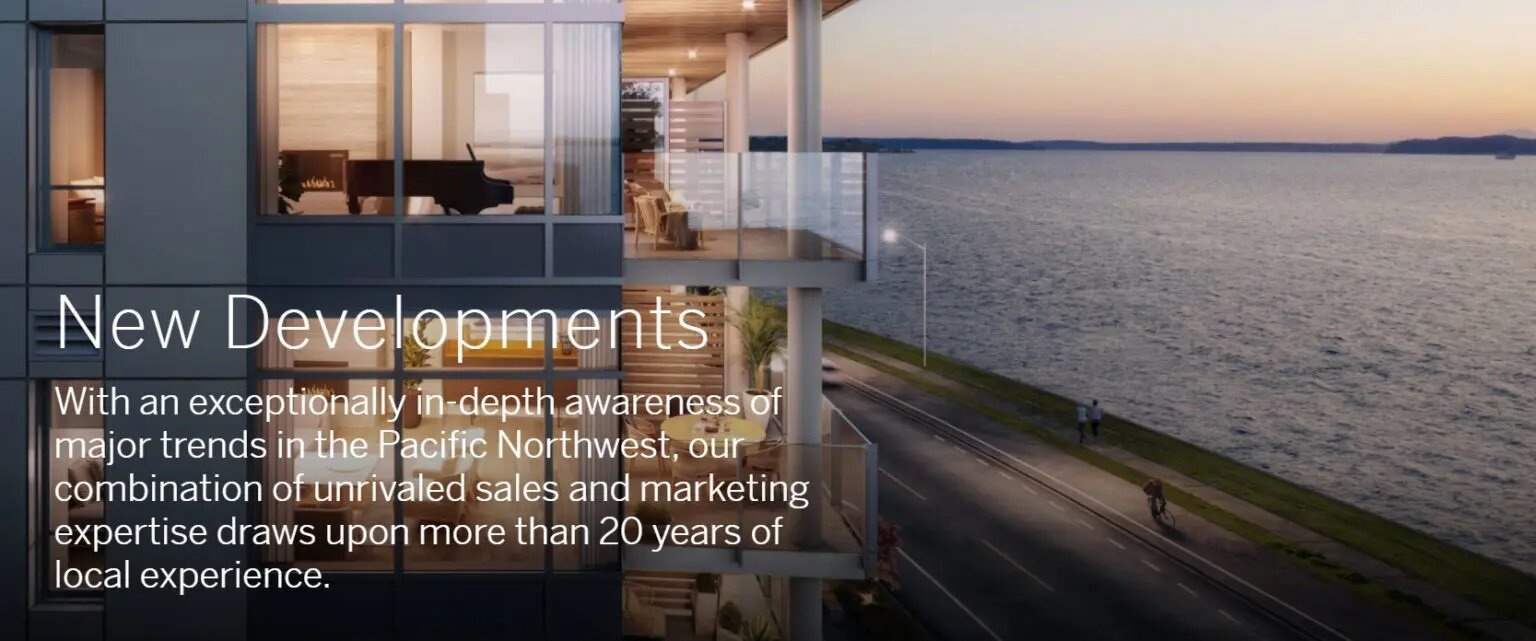

Realogics Sotheby's International Realty is releasing two reports this year to help buyers and sellers in the Puget Sound real estate market make informed decisions. To begin, the 2021 Exclusive Report examines how Seattle's burgeoning and diverse economy has fueled unprecedented development and population growth, indicating a clear urbanization trend.

The Condo Revival - An In-City Turning Point as Buyers Return to City Living

As home prices in the Seattle metro area continue to rise, affordability has become an increasingly elusive goal, as has timed the market for developer incentives and today's historically low, but rising, interest rates. According to The Seattle Times, condominium sales in Seattle increased 121.2 percent year over year, while median prices increased 4.5 percent compared to April 2020.

Q3-2020 Market Trends (Seattle, Eastside, Bainbridge Island)

The real estate market has largely been a beacon of positivity in an extraordinary year. Every quarter, Realogics Sotheby's International Realty (RSIR) looks at these five market areas to determine where our market has been and plan for where it is going next.